Shocking 42% of startups fail due to a lack of market research analysis. Success of modern business requires more than just a good idea — it demands insightful market analysis. How to conduct a market research analysis? This article talks about stages, tools, methods, and common mistakes. In clear language with real examples.

What is market research analysis?

Market research analysis is the collection, analysis and comparison of data for making strategic decisions. After analysis, you can choose the segment to which you should direct your promotion strategy, determine sales volumes, and make business development forecasts.

As part of market analysis, researchers study the macro environment – political, economic, demographic, cultural, and technological factors that affect the company. Analyzing and forecasting customer demand is also a part of the research.

Why, when and who needs a market research analysis of the industry?

Market research analysis is necessary for any company:

- For startups. At the start of a business, you need to understand whether there is a market at all. How much people need the entrepreneur’s idea, whether there is a free market in the niche, what the market capacity and volume is, etc. For example, if a niche is not formed, it will take a lot of money to create it. If there is a niche, but the demand is not as big as desired, you need to find a new direction, atypical for your product. Investors also require market research. They want to understand whether they are investing in a promising business.

- For an operating business of any size. You need to keep abreast all the time. If you don’t keep an eye on the macro-environment, it is easy to lose your leadership position. Even a negative situation can be turned in your favor. The main thing is to be aware of the risk in advance.

For example, when the Covid-19 pandemic started, restrictions were set for people to not leave their homes. Many brands quickly adapted: they introduced contactless delivery, offline businesses moved online, companies revised their assortment and left the most relevant products for people under quarantine.

How to conduct a market research analysis. Tools and methods

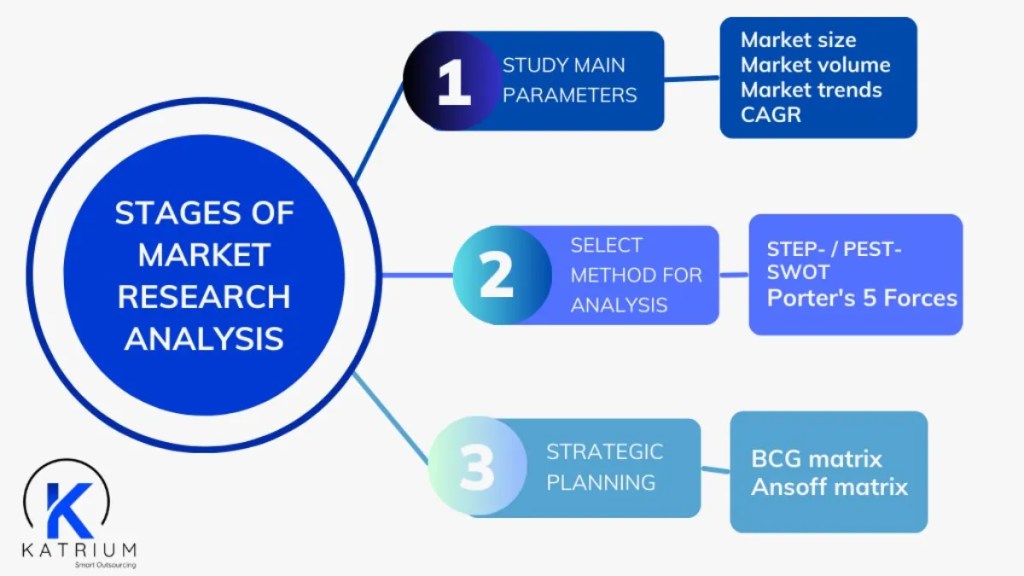

The stages of market research analysis can be divided into 3:

- Investigation of the main parameters.

- Selection of the method for the analysis.

- Strategic planning.

Step 1: Study the main parameters

Regardless of what kind of company you have and what market research analysis methods you want to use, there are 4 main metrics to study:

1. Market size

Approximately how much of a product consumer in a particular market can buy.

Basic formula: Number of target audience x Consumption rate for a specific period.

2. Market volume

The actual number of sales, the actual demand. To find out the market volume, you need to choose a period (for example, a year) and see how many goods were sold during that time.

It is important to look at both volume and size. This is the only way to understand how much you can hypothetically sell. There are times when size equals volume. This means that there is nowhere to grow. That is, there is no need to build new lines to produce a particular product, because there will be no demand. And if you still want to expand, you need to look for new niches. You can see even more data if you look at the dynamics of market size.

3. CAGR (Compound annual growth rate)

By how many percents sales of a product increase per year. In market research analysis this parameter helps to forecast the growth or decrease in sales. You should look at the dynamics for at least 5 years, and preferably for 10. This is especially important for strategic planning. If you study the data for a shorter period, you may not see the big picture. You need to look at how the market is growing and how stable it is.

Market research analysis provides us with important insights. If sales go up and down, it means that the market is highly dependent on external factors. If there is no stability in the market, it will be difficult for a new company to start a business. A large organization can save money and try to start a new product under such conditions. If you look at the dynamics of an existing business, you will be able to determine the speed of sales growth.

4. Market trends

Growth engines and restraining factors. It is also better to look at this parameter for 5-10 years.

What trends could be there? For example, during the COVID-19 pandemic, a manufacturer of household chemicals recorded a jump in sales: people were afraid of the virus and bought products for cleaning surfaces. In this case, the virus became a growth engine for household chemicals sellers.

Because of the constant ups and downs that a research study of dynamics needs to be done 5-10 years in advance. When we see that there is a sharp jump, the question arises, “Will the market continue to move at the same pace?” Right now, there is a big downturn in the market for household chemicals and soon their sales will return to the numbers they had in pre-Covid times.

Of course, there are many other parameters to pay attention to conducting market research analysis, but even these four will be enough to see the big picture.

Step 2: Select market research analysis methods

The methods of marketing analysis are diverse. Let’s look at three popular types of market analysis.

STEP- and PEST-analysis

STEP-analysis is a method by which the macro-environment of an organization is analyzed: S – social, T – technological, E – economic, P – political. The goal is to determine the impact of all elements of the macro environment on the company’s activities and figure out how to interact with it to minimize risks and find opportunities for growth.

STEP analysis involves 3 steps:

- Brainstorming. You need to identify factors that affect the organization.

- Scoring. Each factor should be given a score, where 1 is a low impact on the organization and 3 is a high impact.

- Strategizing. You need to look at the factors that affect the company the most and figure out how to minimize the risks associated with them.

There is also PEST analysis. This is the same as STEP, but the method suggests paying attention to political factors first and technology last.

For countries where business in the country is highly dependent on the political environment, PEST analysis is more suitable. In countries where the situation is stable from the political point of view, social factors come to the fore. People in such countries think more about culture, socialization, and introduction of new technologies, so STEP analysis is used there.

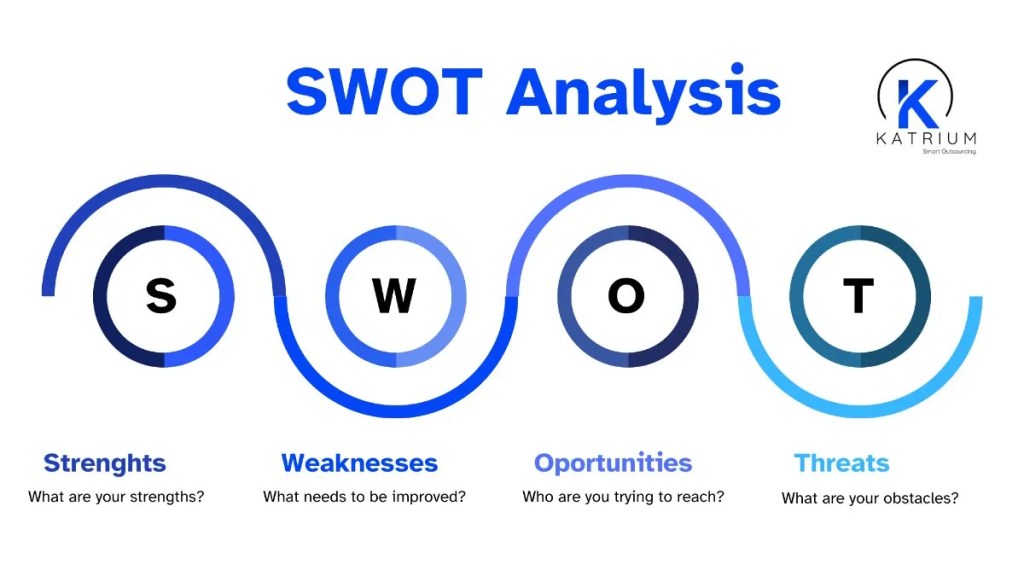

SWOT analysis

SWOT analysis aims to objectively assess a business: its strengths and weaknesses, as well as what external factors can hinder success or, on the contrary, help. If a company understands where its weaknesses are, it can predict problems and act before they occur.

Let’s go back to the fast-food business for example. Its weakness is unhealthy food. When a company adds salads and sugar-free sodas to the menu, the business does not become an example of a healthy lifestyle. However, the alternative on the menu lowers the degree of public outrage.

Don’t stop at one research method. Market research analysis tools should be used in combination. When you have studied how your business is affected by the external environment and have looked at the weaknesses of your company, you can move on to strategic planning.

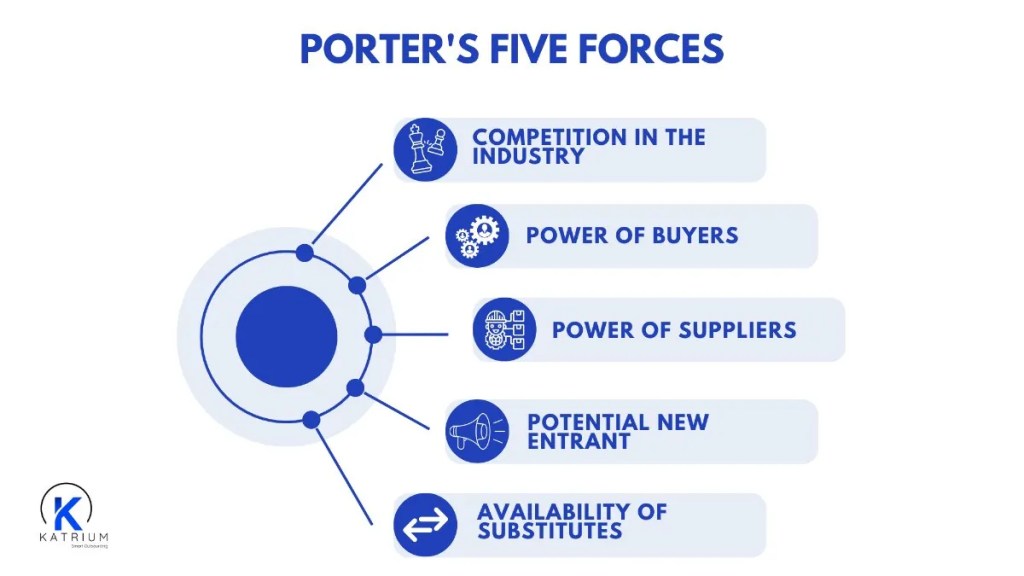

Porter’s Five Forces

This method is designed to assess potential risks. Michael Porter says that business is affected by 5 forces:

1. The level of competition.

Study the current number of competitors, whether the market is not oversaturated with them. For example, there are a lot of Korean cosmetics on the market right now. If you don’t have a sufficient marketing budget, it will be difficult to gain a foothold in this business because of the high competition.

It is also bad when there are no competitors. This means that the niche is not formed and you will have to create it. In this situation, the risks are very high. You should start a business only if you are sure that the product is innovative or if you have a lot of money that you are willing to lose.

2. The risk of buyer power.

There are businesses with a very narrow audience. They occupy a niche with only 10-20 customers. Since there are few customers, the manufacturer is dependent on them. For example, this happens in the space industry. Buyers of parts for space equipment can dictate the rules to manufacturing companies.

3. The risk of supplier power.

Market research analysis shows that the production of a particular product can be highly dependent on the supplier.

4. Risk of new competitors.

You need to find out how likely it is that new and strong players will soon appear in the market. Imagine you want to build a factory to produce a product. You need to investigate whether companies are building other similar factories.

5. Risk of substitute products.

You need to analyze the product market and understand what consumers can buy instead of your product. For example, there is a popular herbicide glyphosate. Right now, it has no analogs. However, the public is worried that glyphosate is bad for the environment. Therefore, as soon as a safe substitute becomes available, consumers will immediately switch to the more environmentally friendly option.

It is enough to carry out a competitive market research analysis once or twice a year and sometimes review the main news related to the activities of your competitors. But the company should always analyze the target audience. Periodically conduct in-depth interviews and focus groups. Some parameters should be constantly monitored, such as NPS (customer loyalty index). Only customers can tell you what they want to buy and what kind of advertising will help them decide to buy.

Don’t forget about other research methods such as expert interviews, hall-tests and home-tests. These are basic types of research that are still effective.

Step 3: Strategic Planning

When the market assessment is ready, you can create a plan of action. Here are two tools that can help you form a strategy based on the results of the market research analysis.

BCG matrix

BCG matrix (Boston Consult Group Matrix) helps to evaluate the success of products. It is a tool for business optimization. The goal is to find the products that are sold the least and eliminate them so as not to spend money on their production and promotion.

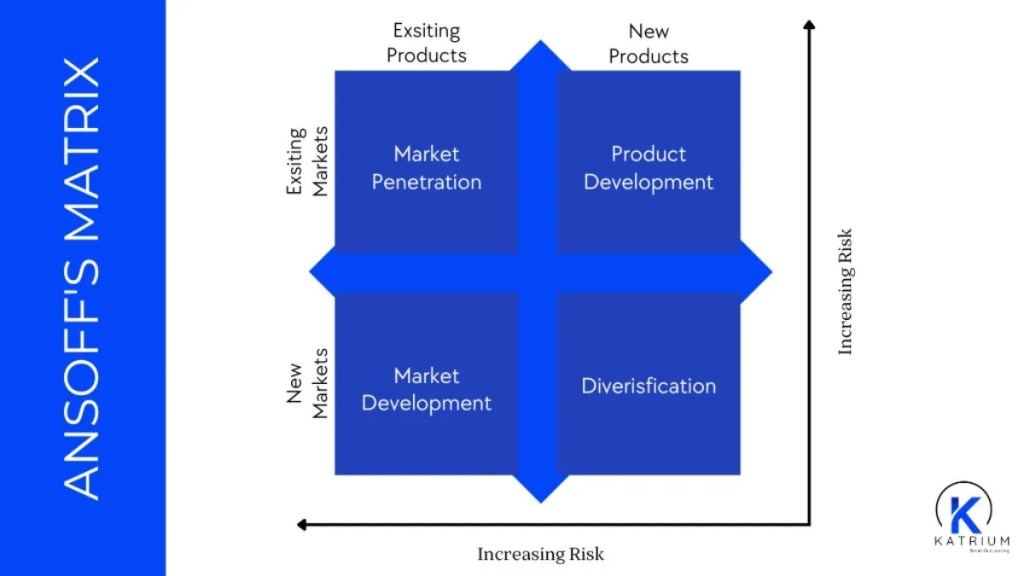

Ansoff matrix

The Ansoff matrix, or product-market matrix, is a model that describes the possible growth strategies of a company in the market. It helps you understand what you are doing now with your product and where to go next. The matrix is divided into four segments:

- existing market and existing product,

- existing product and new market,

- existing market and new product,

- new market and new product.

Each segment has its own development strategy:

1. Market penetration. The essence is to sell as many products as possible. To realize the strategy, companies often increase marketing costs or minimize costs to reduce the price of the product.

2. Market Development. One use this strategy to enter new markets with existing products. To realize it, one can:

- find a new segment of consumers,

- sell products in a different region,

- start selling in another country.

3. Product development. If a company has been on the market for a long time and has a loyal audience, it is possible to create a related product and sell it to the same target audience. For example, a facial cosmetic brand starts selling hair products.

4. Diversification. This is the riskiest strategy. You develop a new product and try to bring it to the market. Often companies create an entirely new brand to avoid confusing their old audience.

What mistakes companies make when conducting market research analysis

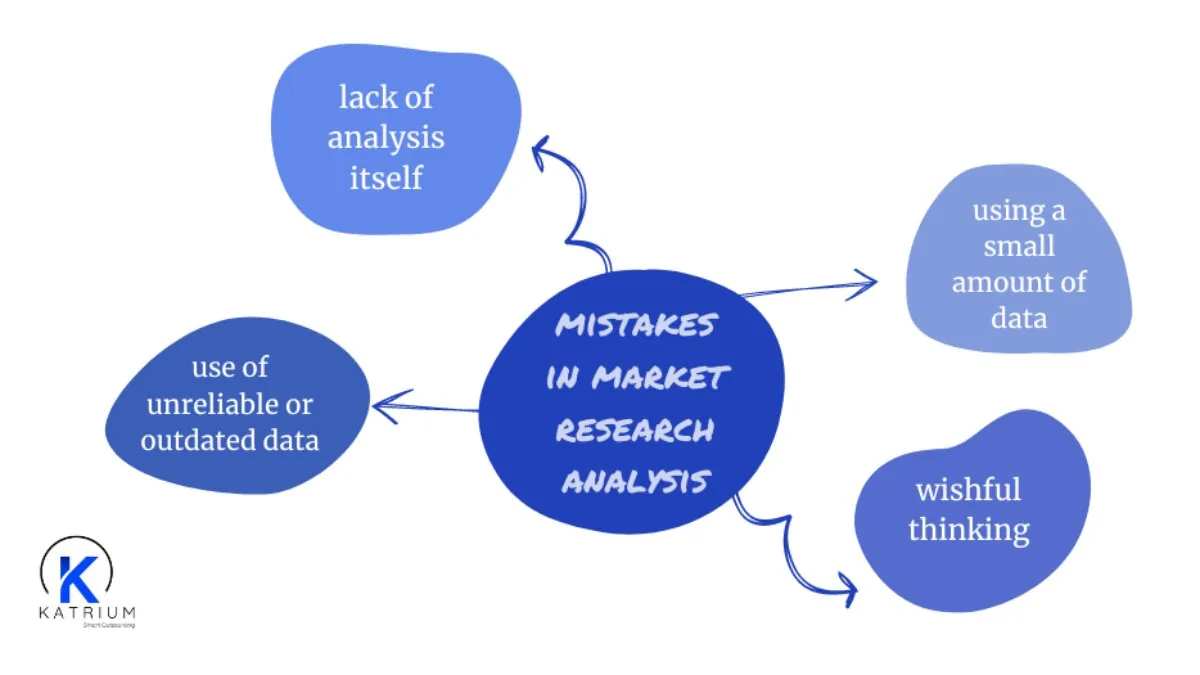

The first and most common mistake is the lack of analysis itself. Modern companies analyze their audience and watch their competitors, but market research analysis is very rare. Companies usually start deep market research when they start to have big problems. Unfortunately, in such situations it is too late to analyze.

The second mistake is the use of unreliable or outdated data. It is not enough to simply find an article with statistics in a search engine and make a market analysis based on it. It is necessary to use data only from verified organizations. Also, do not use old data. You are selling a product now, which means that the market data must be up to date.

The third mistake is using a small amount of data. If you conduct a survey of 20 people, you will get unrepresentative data. You need 300 to 3000 respondents for a survey. If you want to study a company’s sales, the data should be studied for 5 to 10 years. For various reasons, a year can be very profitable or, on the contrary, unsuccessful. You can notice patterns only if you have data for several years in front of you.

The fourth mistake is wishful thinking. Sometimes it’s hard to accept the bitter truth that research shows. But you do the analysis to get to the bottom of the problem. You can only find a solution if you interpret the data collected with a cool head.

Market research analysis helps you to understand whether a business is losing ground, where to go next and how to get out of a crisis, and tells you which promotional channel and product to invest in. Do not neglect this tool and conduct research more often. Get in touch with us today for market research customized to fit your specific needs!

5 Responses