Customer satisfaction surveys are one way – among others – to gather feedback from your clients. Let’s imagine you started as a small business where you could interact with the incoming people face-to-face. They could share their likes, dislikes, and ideas about your product right there on the spot. But as any business grows, it becomes more and more difficult to ask each person about their experience individually.

That’s the reason for conducting customer satisfaction surveys. You stay informed about your customers’ needs, their loyalty level, and their ideas for improvement. However, very often, people are not interested in cooperating. They have no motivation to participate. But why does this happen? In this Katrium article, we’ll look at possible reasons and give some tips on creating effective customer satisfaction surveys, increasing response rates, and using survey data to improve business strategies.

Types of Customer Satisfaction Surveys

There are various types of customer satisfaction surveys. Here we will cover four of them:

- Customer Satisfaction Score (CSAT)

CSAT is a simple scale showing how positive your customers’ specific interaction was. The scale typically goes from 1 to 5, where 1 being ‘not satisfied’ at all and 5 being ‘very satisfied’. Alternatively, you can use smiley faces instead of numbers. This way, you’ll get an average satisfaction score using the formula:

(total scores / total respondents) x 100.

- Net Promoter Score (NPS)

This type of customer satisfaction survey shows your customers’ loyalty to your brand. Essentially, it tries to measure the overall relationship between company and consumer. This is commonly used in both B2C and B2B. It is the most popular measure of customer loyalty.

Similarly to CSAT, it also uses a scale, but this time from 1 to 10. The questions can be different. You can ask, ‘How likely are you to recommend this brand/app/product to a friend?’ Based on their answers, you divide your customers into three groups: Detractors (score from 0 to 5), Passives (score from 7 to 8) or Promoters (score from 9 to 10). Use the formula to calculate NPS:

% of promoters – % of detractors.

Neutrals generally do not affect your brand image.

- Customer Effort Score (CES)

CES shows how much effort your customer needs to put in to achieve their goal. What this means is that it measures whether it is difficult or easy for the customer to perform a task or interact in the company. The lower the score, the better. The recommendation here is to use a scale from 1 to 7 for the answers. The question starts with ‘How easy was it to … ?’ In order to measure CES, use the following formula:

total score / total respondents

Here you can also ask your customers to explain why they chose that answer and receive more insights.

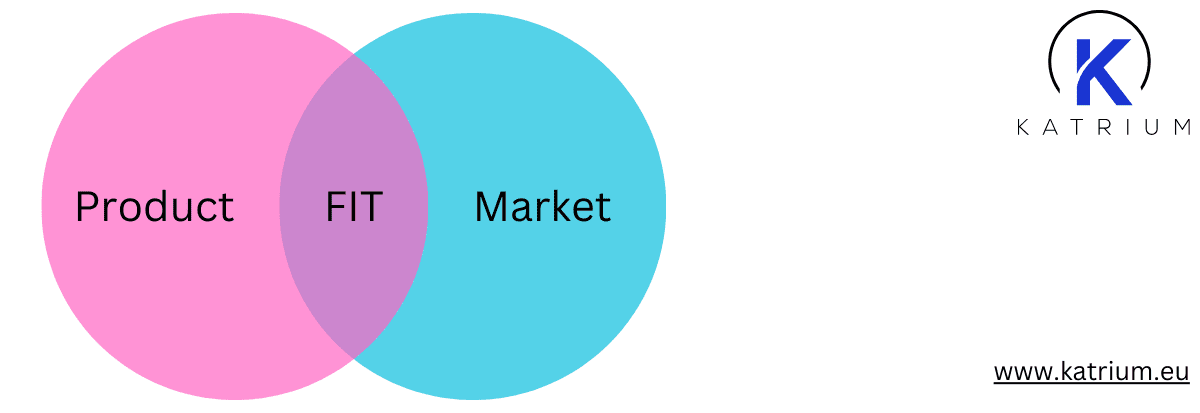

- Product-Market Fit (PMF)

PMF is one of the most important customer satisfaction surveys. It shows whether your products meet customer expectations and needs.

To find that out, you can use the Sean Ellis test. Ask your customers the question: ‘How would you feel if you could no longer use the product?’ And give them three options to choose from: ‘Very disappointed,’ ‘Somewhat disappointed,’ or ‘Not disappointed.’

The second way to rate PMF is the Comprehensive Satisfaction Survey. It includes various questions about overall customer satisfaction, usability and value of your product. By analysing the survey responses you get the general understanding of how well your product fits into the market.

Why Customers Don’t Respond: Common Pitfalls

Even though customer satisfaction surveys are extremely important for your business, customers may not engage with them for multiple reasons:

- Vagueness: Surveys with ambiguous, not clear, or leading questions can result in bias in responses, leading to unreliable data.

- Length: Surveys that are too long can bore and discourage respondents, leading to incomplete responses.

- Improper design: Dull subject lines, lack of personalisation, and not giving an option to skip certain questions can make surveys less appealing to customers.

- Availability: You want as many people as possible to respond to your survey. If it is not mobile optimized, for instance, customers may avoid responding out of inconvenience.

- Repetition: Frequent and repetitive surveys can lead to survey fatigue, with customers losing interest and not engaging anymore.

- Irrelevant Questions: Questions which are not related to the product or the customer’s experience cause frustration.

- Survey Privacy Concerns: People are not sure about how the data they provide will be used. So they are afraid to take risks by providing personal information.

Crafting Surveys That Customers Want to Complete

Let’s point out some tips on writing engaging and clear questions for your customer satisfaction surveys that customers would like to answer.

- Keep it simple: Use simple language, wording and formatting to avoid confusion. Avoid using internal terminology or abbreviations, as not all customers will know the jargon.

- Keep it short: Your customers are busy people. Remember that if the customer satisfaction surveys take more than five minutes to complete, the less customers will do it. It is better to do several short surveys than just a couple of large ones.

- Be straightforward: Write straightforward questions that directly address the survey’s goal.

- Define your objectives: Clearly define what you’re trying to achieve with the question.

- Neutrality and objectivity: Stay neutral and unbiased to avoid influencing the responses.

- Offer a range of response options: Provide response options that reflect the possible variations in the answer.

- Ask open-ended questions: Questions starting with ‘Why’ are extremely valuable for your business. But make sure you have the time and means to analyse the answers manually.

- Use interactive elements: Make it more fun and visually appealing for your customers.

- Give motivation: Think about what your customer will gain by filling out the survey. A great way to thank them for their time is to offer them a discount or a cup of coffee with their next purchase.

Let us know in the comment section below what works best for your business.

Timing Is Everything: When is it Best to Send Customer Satisfaction Surveys

Unfortunately perfectly crafted customer satisfaction surveys are only half a deal. Another thing to consider is timing. So when is the best time to send a survey if you want to get the most feedback?

First of all, it is better to be a weekday. Monday is actually the best of all. People are starting their working week and you can give them a way to procrastinate a bit. Customer satisfaction surveys sent at the end of a workday (6-9 p.m.) tend to get most responses.

A type of survey also matters. It is recommended that you send your post-purchase customer satisfaction survey 24-48 hours after the transaction. Customers still remember their experience well and share it more willingly. Although, if it was an online purchase, remember to add the estimated time of delivery to that timing or wait until the delivery if confirmed.

After customer service interactions make sure to send customer satisfaction surveys right after the conversation ends.

To check overall satisfaction and loyalty of your customers, you can use periodic or recurring surveys. But do not send them too often, you don’t want to cause them survey fatigue.

Anyway, it is usually a bad idea to send your customer satisfaction surveys at weekends, holidays or other potentially busy times. Try to think about your customers’ routine and when they can be in the right mood for filling out a survey.

How to Analyse and Use Survey Data

Now, when you have collected all the data from your customer satisfaction surveys, you need to analyse it and use it to your company’s advantage. Whatever method you decide to use, every part of the company needs to know they have a role to play in the experience. Make sure the results are visible for each department.

The data can be quantitative (i.e. numerical) as from Customer satisfaction score survey. You can easily use it for tracking changes over time. Also, the data can be qualitative. It contains non-numerical information as when you ask your customers a follow-up question to explain their answer. This type of data is obviously more difficult to analyse, but it is also extremely important.

Before the analysis, you need to ‘clean’ your data. Remove all the low-quality data, make it easy to read and process. You can use any kind of tables such as Excel, Google sheets or more professional survey analysis software. Use data visualisation tools the software provides.

Filter the data collected from customer satisfaction surveys by cross-tabulating subgroups, for example by gender, age, jobs to get responses from customers with a specific background. This will give you a fuller picture of the situation in different customer subgroups. And it is also an instruction for focused action.

Compare the results to your competitors, industry averages or yourself over different periods of time. The process is called benchmarking. It shows how your previous decisions influenced customer satisfaction.

In open-ended questions, search for repetitive words and phrases. Group and count them. They will give you deeper insights and explain why you got that numerical data.

With the results on your hands, you can work on your development strategy and start brainstorming ideas on improving your performance.

Recap: Improving Your Customer Satisfaction Surveys for Better Engagement

Customer satisfaction surveys are a key tool for collecting valuable feedback about your customers’ experience and loyalty. However, customers are not always willing to engage. Common pitfalls such as unclear questions, lengthy surveys, and privacy concerns can be the reason.

To increase response rates, it is essential to design surveys that are simple, engaging, and concise. Multiple-choice questions, simple language, and brevity can make surveys more appealing to customers. Adding interactive elements and offering incentives such as discounts can also increase participation.

Timing is key – sending surveys at optimal times, such as shortly after a purchase or customer service interaction, can lead to higher response rates.Once data is collected, it needs to be cleaned and analysed carefully. Both quantitative (numerical) and qualitative (open-ended) data provide information about customer satisfaction. Filtering data by subgroups and benchmarking against industry standards can offer a deeper understanding of customer preferences, helping businesses to adjust their strategies and improve overall performance. And of course, one more component of conducting successful customer satisfaction surveys is a team of professionals. Contact us and find out how Katrium can help in the growth and development of your business!

3 Responses